Expected Launch in 2025

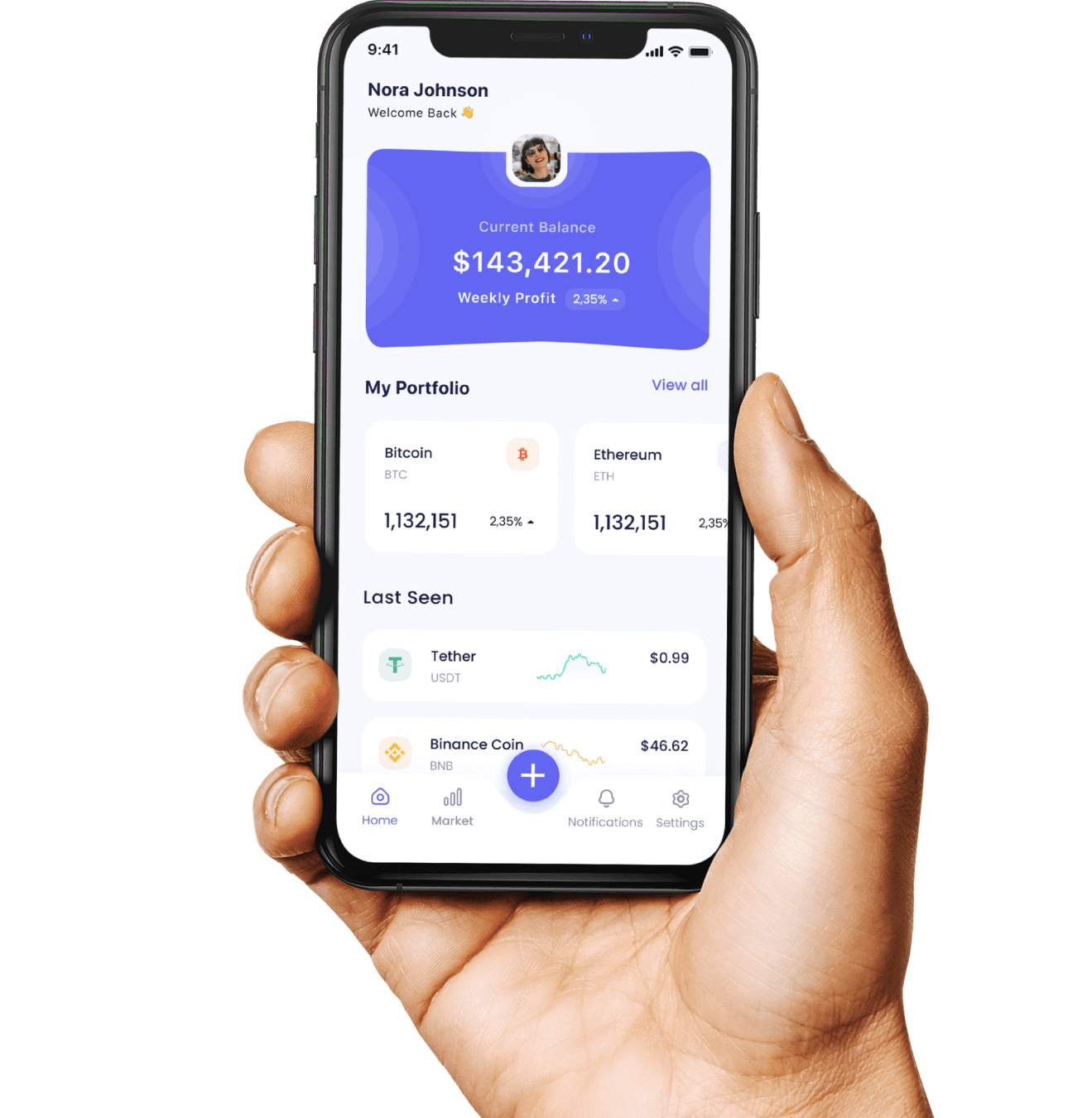

We are currently developing a peer-to-peer marketplace platform that allows trading of cryptocurrency cloud mining hash-rates. Our platform provides a means for mining rig owners to let out their rigs in order to hedge against the market volatility risk, or to gain leverage on their capital, while simultaneously opening up the opportunity for retail investors to participate in cryptocurrency mining on the cloud, giving them a potential stream of passive income.

Cryptocurrency mining is the mechanism for which new cryptocurrencies are introduced into circulation. Cryptocurrency miners use their hardware specifically designed to solve a complex cryptographic problem in order to keep the network secure. As a reward for the work done by the miner, new cryptocurrencies are minted and given to the miner that successfully mines the block.

Cloud mining is the mining of cryptocurrencies by rented computing resources on the cloud without physically owning or operating the hardware. This makes cryptocurrency mining accessible to the general public.

Cryptocurrency mining is not risk free, the profitability is subject to a lot of volatility factors such as cryptocurrency prices, energy costs, introduction of new technologies and the mining difficulty. By letting out a portion of their rigs, cryptocurrency miners can effectively hedge their risks against the volatility, stabilising their income.

It is true that over 90% of the bitcoins that can ever exist have already been mined. However, the block reward isn’t the only source of revenue that crypto miners enjoy. The miner that successfully mines the block will receive all the transaction fees paid by network users in that block. Eventually, transaction fees will be the dominant source of revenue for bitcoin miners. Furthermore, besides bitcoin, a lot of cryptocurrencies still use proof of work as their consensus mechanism and decent block rewards are still available to be mined.

Yes, as we have to comply with our local regulations against money laundering and tax avoidance. However, users with daily transaction volume below a certain threshold need not complete KYC in order to use our platform.

What forms of payment do you accept to use the platform?

Yes, this is part of our plan. However, to be compliant with the relevant regulations, we most likely will handle transactions without holding customer’s assets in custody. This can be achieved by means of a smart contract.

Cryptocurrency mining is the process by which new cryptocurrencies are introduced into circulation. Miners use specialized hardware to solve cryptographic problems and secure the network, earning rewards in return.

Cloud mining involves renting computing resources from the cloud to mine cryptocurrencies, making mining accessible without owning the physical hardware.

Mining profitability is subject to volatility (crypto prices, energy costs, technology advancements, difficulty). Letting out rigs helps miners hedge risks and stabilize income.

While most bitcoins have been mined, miners can still earn transaction fees from successful blocks. Additionally, many cryptocurrencies still use proof of work and offer decent rewards.

Yes, KYC is required to comply with local regulations against money laundering and tax avoidance. However, users with lower transaction volumes might be exempt.

Initially, only fiat currency (via card or PayPal) will be accepted.

Yes, we plan to enable crypto payments, but to comply with regulations, we’ll likely use smart contracts to avoid holding customers’ assets in custody.

One of the biggest features that makes our platform superior to any other in existence is the introduction of powerful analytical tools based on mathematical models.

As the concept of cloud mining is relatively new, the pricing of cloud mining contracts available in the market is completely arbitrary and not systematic.

We model cloud mining contracts using the Black-Scholes framework, treating them as dividend-paying call options to assess risks and returns based on cryptocurrency.

Our pricing model eliminates all possibilities of making a risk-free profit through arbitrage, effectively justifying it as fair and transparent pricing in an efficient market.

For mining rig owners, a new challenge arises: how many rigs should be let out to maximize expected returns and optimize resource utilization effectively and efficiently?

Not letting any rigs out may lead to significant losses during unfavorable market conditions, while letting all rigs out means missing out on potential price surges.

The optimal solution lies in the middle, carefully determined by the Kelly criterion, which maximizes expected returns while effectively managing risks and ensuring sustainable growth.

Both of the above features are exclusively accessible through our premium subscription, providing users with enhanced functionality and added benefits.

Copyright © 2024 Crypto Mattock. All Rights Reserved.